Build Your Monthly Budget Template with the Zero-Based Budget Method

If you landed here, then you’re probably ready to take control of your money… but every month, it feels like your paycheck disappears faster than you can plan for it.

The truth? You don’t just need a budget. You need a budget that tells every single dollar exactly where to go, so you’re never wondering, “Where did all my money go?” again.

That’s where zero-based budgeting comes in. And today, you’re not only going to learn how it works, you’re also getting a free monthly bill tracker so you can start building your own budget template today.

Why Zero-Based Budgeting Works

Unlike “traditional” budgeting, where you loosely estimate what you’ll spend based on last month’s numbers, zero-based budgeting starts from scratch every month. You assign every single dollar a job whether that’s bills, savings, debt payoff, or a fun splurge.

By the end of your budget, your total income minus your total expenses should equal zero. That doesn’t mean you have zero money left — it means you’ve planned for every single penny, so your money works for you instead of disappearing without a trace. This is where the magic is.

This method works because:

It forces clarity — You’ll see exactly where your money is going.

It builds discipline — You make intentional spending decisions before the month starts.

It adapts easily — Life changes, and so can your categories and priorities.

Step 1: Start with Your Monthly Income

Write down your total monthly income after taxes. If your income varies, use your lowest average month to avoid overbudgeting. You don’t want to estimate that your paycheck every two weeks will be $1200 when it’s really $970. That’s how debt starts.

Step 2: List Every Expense Using Budget Categories

Here’s where most budgets fail — they’re too vague. “Groceries” and “Bills” aren’t enough. You need clear, specific categories so you can see exactly where your money is going.

Here are 29 budget categories you can choose from (pulled from the categories I use in my own zero-based budget):

Housing & Essentials

Rent/Mortgage

Utilities

Grocery Store

Farmer’s Market

Transportation

Insurance

Medical Expenses

Family & Kids

Childcare

School Supplies

Kids’ Weekend Fun

Kids’ Toys

Extracurriculars

Kids’ Medical

Kids’ Clothing

Kids’ Hair appointments

Home & Lifestyle

Clothing

Household Supplies

Home decor

Car Maintenance

Home Maintenance

Dining Out

Subscriptions

Personal Care

Gym Membership

Pet Care

Pet Food

Pet Groomers/Boarding

Financial Goals

Savings

Debt Payments

Gifts

Education

Vacation

Daytrips

Just because I’m budgeting, it doesn’t mean I’m only putting my money towards bills. Life is too short, so I intentionally create buckets for shopping, restaurants, and vacation.

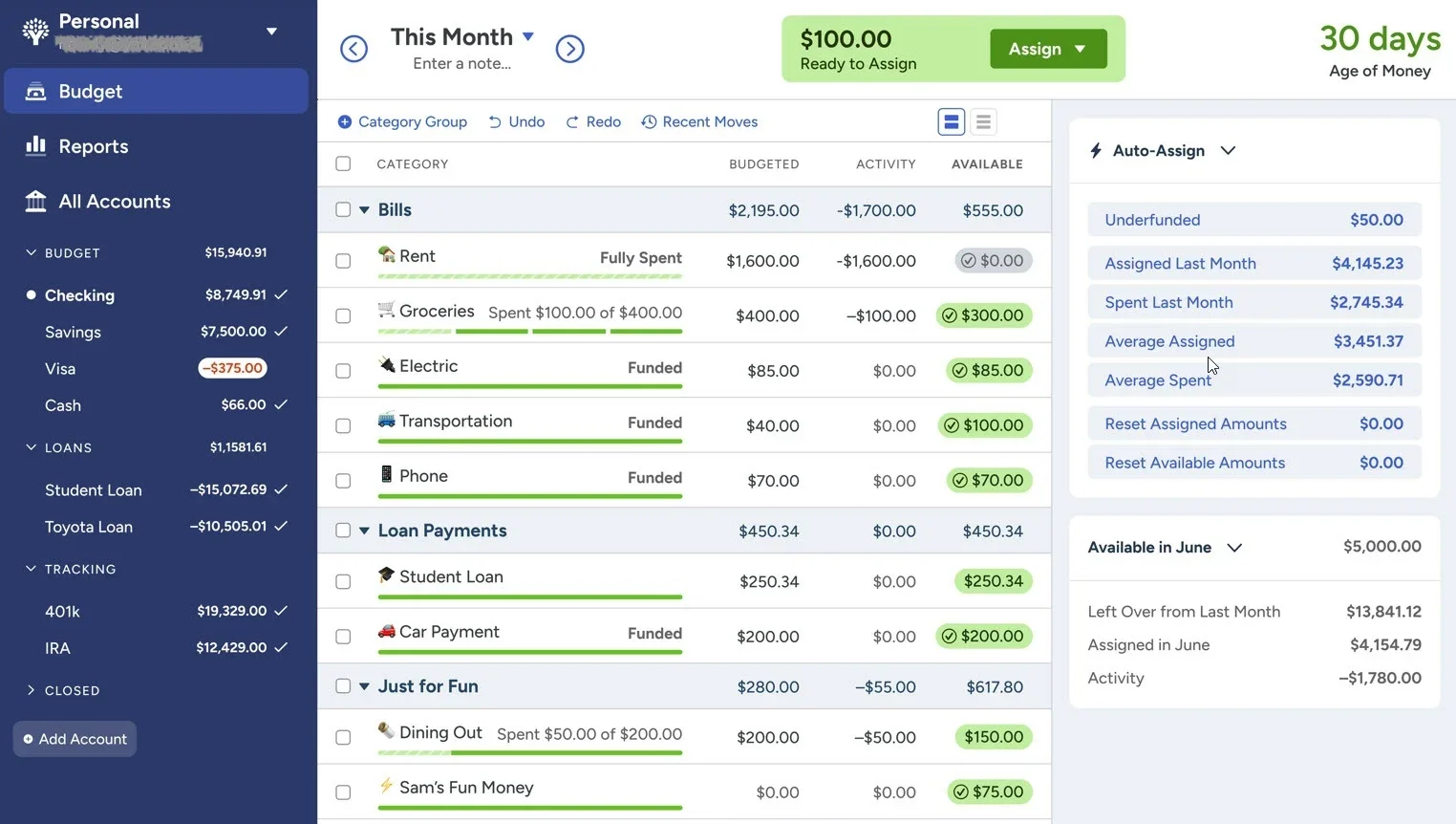

Step 3: Use a Zero Based Budgeting App like YNAB

If you want a reliable digital version of your zero-based budget, I highly recommend YNAB (You Need A Budget). It’s specifically designed for this exact budgeting method, making it easy to assign every dollar a job. The app syncs seamlessly across all your devices, so you always have access to your budget, whether you’re on your phone, tablet, or computer. Plus, YNAB provides clear, detailed reports that help you track your progress toward your financial goals in a way that feels manageable and encouraging.

Step 4: Review & Adjust Every Month

Your budget isn’t “set and forget.” Check in daily to track your spending and adjust as needed. Remember, it takes 21 days to form a habit. So, this first month is all about building the muscle memory to check your budget and bank accounts. Over time, you’ll see where you can cut, save more, or shift money toward your bigger goals.

Final Word

Zero-based budgeting isn’t about restriction — it’s about direction. You’re telling your money exactly where to go, so you can finally feel in control.